With hundreds of health plan options on the market, member experience is becoming more and more important for health plans. Obviously, health plans want to have a good relationship with the members they are serving because that’s just plain good business. But also, more satisfied members lead to higher ratings which leads to better plan performance which in turn leads to better health for members. And when members are happier and healthier, costs go down and star ratings go up. Which leads to–you guessed it–more opportunities for funding for those health plans.

With member experience being such a key factor in the financial growth of health plans, it’s surprising that many plans have been slow to come around to the customer centered business ideas that have been around for many years. Health plan shortcomings in this area have become even more apparent in recent years as reports are released that millions of Americans are choosing to forego insurance completely due to dissatisfaction with various aspects of member engagement.

In order to shift the way people view their current health plans, plans have started making adjustments to increase member experience and in turn, member satisfaction. Below, we’ve outlined some of the ideas and strategies that have worked.

Factor #1: Ensure a personalized member experience

Ensuring a personalized member experience puts the member back in the center of their health care decisions. While it seems like a little thing, by making sure each member has the perks, benefits and services they need, you're making sure that that member’s personal needs are met. You essentially help members to build a relationship between the plan and the member that becomes the cornerstone of their health care experience.

Here are some ways you can personalize member experience:

- Add programs, supplemental benefits and services that benefit the whole person. Focus these programs not just on physical health, but also the mental health.

- Find ways to support members that go beyond basic coverage–things like social support benefits, education opportunities or wellness benefits all make a huge difference.

- Listen to member complaints and make sure that members see beneficial changes in plan after communicating what is not working.

- Make sure your customer service is empathetic, kind and fast. (Yep, that means if your wait times to talk to a representative are too long, you’re not driving a good member experience.)

Factor #2: Help your members to understand their coverage

A study done in 2019 by PolicyGenius said 1 in 4 people said not understanding their coverage led them to avoid following through with treatments. It’s a fact: Your average person (even really smart, educated people) just don’t get “health plan speak.”

Here are some ways you can help members understand their health plan:

- Train your customer service team (and your technical writers) to use common, everyday language and to clearly define health plan terminology like co-pay or premium while talking to members.

- Offer caregiver benefits (like Papa) to give your members one-on-one human support to help them to better access their health benefits.

- When talking to a member, encourage your customer support team to make sure they understand all the medical terms associated with their specific health needs. The phrase, “do you need further explanation?” should be used often.

- If your plan offers programs that are outside of the scope of basic coverage, make sure you clearly inform your members of what supplemental benefits or additional services are available for them. If possible, provide clear web pages or printed documentation of these offerings.

- Offer multiple different forms of communication for members. Some people prefer to talk to a real person on the phone, others like email and still others would rather use a mobile app. The more ways to communicate with your members, the more effective their experience will be.

Factor #3: Offer high-tech and low-tech tools for access to care

We live in a very fast paced, “need everything at my fingertips'' world. We move fast, need answers fast, want to get all of our bills paid fast and get appointments scheduled quickly and with ease and then move on. It may be Gen Z's worst nightmare to have to call the insurance company, go through 10 robo instructions and then wait on hold for an hour to ask a simple coverage or network question, but other generations prefer that to navigating complicated technology. Because of this, one of the most important things your plan can offer is a variety of tools that make communication and access to care easy and accessible.

- In addition to old-fashioned phone appointments, provide an option for scheduling appointments and procedures online or on an app.

- Allow for telemedicine appointments for visits that don’t require an actual physical exam.

- Give easy access to coverage and provider information both online and in a mobile app.

- Offer a search page where members can find doctor offices and pharmacy locations nearby and sort by rating.

- Give members the ability to access their medical records through a password protected portal.

- Offer ways to pay their health bills and access statements online.

- Add the capability to monitor health through tools like Fitbits or Apple watches.

Factor #4: Creative management of preventative care

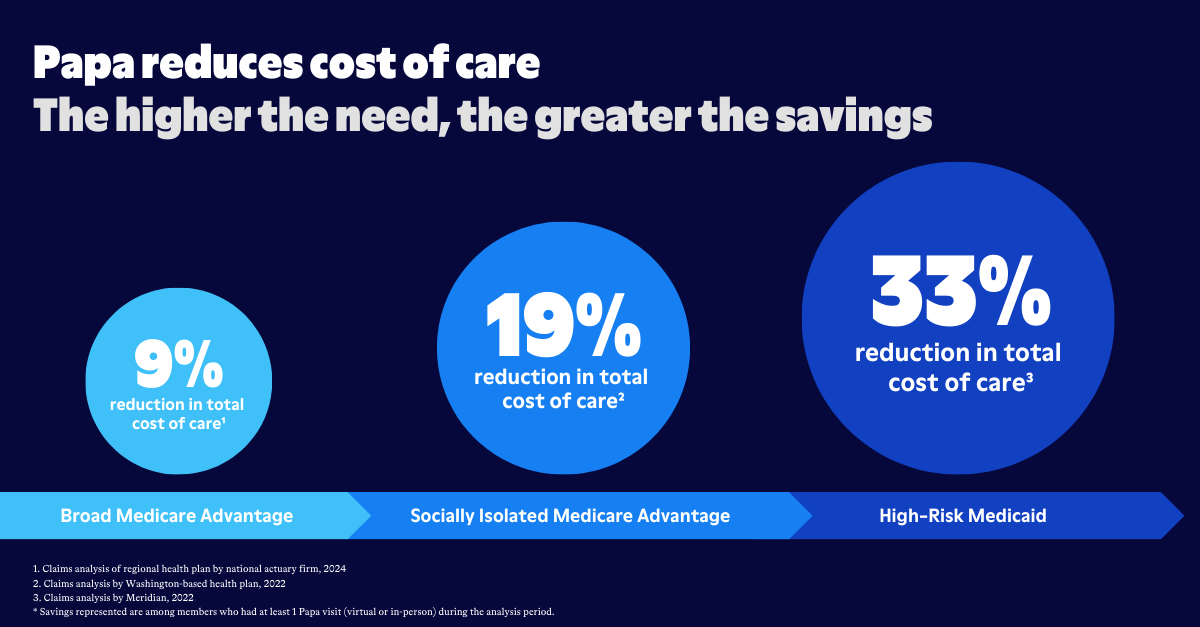

Screenings, vaccines, and check-ups are essential parts of any health plan, but it may be surprising to know how much they impact member experience. By ensuring that members have access to (and understanding of) preventative care options, you essentially help them to avoid chronic disease and major issues. This means a lot, for both member health and your plan's financial health.

Here are some innovative ways to encourage your members to keep up with preventative care:

- Offer member rewards, like vouchers, gift cards, discounts or even badges on their profile, for things like going to your annual PCP check up.

- Send regular reminders about the preventative care available to your members. Postcards and email notifications are common, but we've also seen health plans use SMS text notifications.

- Reduce out of pocket costs for preventative care. Many plans offer $0 co-pays on preventative appointments.

- Provide discounts for a gym membership or other wellness programs to make sure people stay healthy outside of regular visits.

- Make sure that supplemental options like mental health support and nutrition support are part of your plan.

- Offer rides to appointments through companies like Papa.

These may seem like small steps, but each has been proven to increase member engagement–and in doing so, CMS star ratings! By focusing on improving the experience for each member, health plans can improve member health, and save money in the process.